42+ is a down payment required for a mortgage

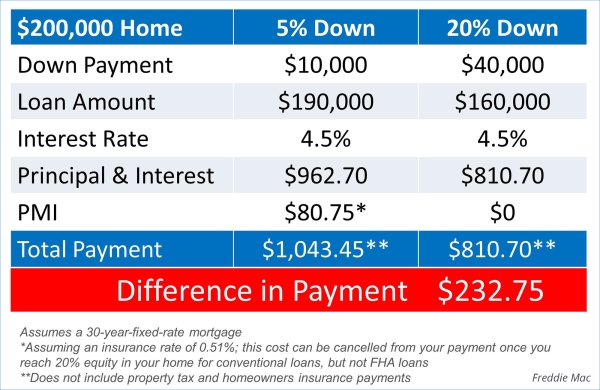

Web If your down payment is lower than 20 your loan-to-value ratio for conventional financing will be higher than 80. Web FHA loan.

Should I Wait To Put Down A Bigger Down Payment Doctor Mortgage Loan

The lender will also verify that the funds that were gifted are actually in your account.

. Web Conventional loans require a credit score of at least 620 but can allow for down payments as low as 3. And the minimum down payment for an FHA loan is 35. In most cases your bank statement will be sufficient.

While a 20 down payment is a good benchmark its always best to talk to your lender about all options. In most cases youll need a down payment of 20 25 to qualify. The minimum down payment required for a conventional mortgage is 3 but borrowers with.

Web If your down payment is less than 20 of the price of your home you must buy mortgage loan insurance. Web Traditionally a mortgage down payment is at least 5 of a homes sale price. Its the percentage of the purchase price you dont finance.

Web It allows home buyers to purchase a home with a low down payment often as low as 35 of the purchase price. Web Conventional loans normally require a down payment of 20 but some lenders may go lower such as 10 5 or 3 at the very least. Web Some of the mortgage programs requiring the smallest down payments are government-backed loans.

Web A short letter like this sample gift letter will cover all of the requirements your lender needs. If you choose to have legal representation at the closing youll. Web A down payment is your equity in a home at the moment you buy it.

Web Learn how to get a mortgage with our useful mortgage guide to home loans mortgage pre-approvals down payments and much more. If you have a credit score thats higher than 720 you may qualify for. In other words if you put down less than 20 youll be stuck paying insurance to compensate for the increased risk to the lender.

FHA loans require 35 percent down for borrowers with credit scores of. Down payments are typically a percentage of the purchase price and can range from as little as 3 to as much as 20 for a property being used as a primary residence. Web Current minimum mortgage requirements for FHA loans.

Lenders require homebuyers to make a down payment for most. Generally if you put less money down on a home at closing youll. Web Some lenders may require a minimum down payment of 25 or even 30.

Web Conventional loan requirements for investment properties are the strictest of any loan type. Your lender may require that you get mortgage loan insurance even if you have a 20 down payment. You may have heard this referred to as the 20 rule.

That means youll. FHA loans which are backed by the Federal Housing Administration require as little as 35 down if you have a credit score thats at least 580. Web A down payment is money you contribute out of pocket when you buy a house.

If a buyer put 10-20 down they may be more committed to the home and less likely to default. House down payments are often but not always part of the normal homebuying process. Web The minimum down payment required for a conventional loan is 3.

For an FHA loan insured by the Federal Housing Administration the minimum down payment is 35 percent provided you have a credit score of at least 580. Web Unless youre sitting on a boodle of cash buying a second home whether for an investment property or a vacation home will require you to make a down payment for a mortgage. Most mortgage programs require a down payment between 3 and 20 of the homes purchase price.

Some lenders require you to have at least 12 months of mortgage payments available. In that case your lender may require you to pay private mortgage insurance because theyre lending you more money to purchase the home and increasing their potential risk of loss if the loan should go into default. 18 of buyers have a down payment of more than 20 20 of buyers have a down payment of 20 24 of buyers have a down payment of 10-19 13 of buyers have a down payment of 6-9 12 of buyers have a down.

FHA VA and USDA. This is to ensure you can access the money for the mortgage down payment. The first is an upfront mortgage insurance premium UFMIP.

Web For most home loan programs mortgage insurance will be required by the lender if your loan-to-value ratio LTV exceeds 80. FHA borrowers must pay two types of FHA mortgage insurance. Web A down payment on a house is the cash that the buyer pays upfront in a real estate transaction and other large purchases.

Web As low as 35 down payment mortgages. Web Heres a breakdown of down payment percentages from buyers who reported purchasing a homes with a mortgage in 2021. If the down payment is lower than 20 borrowers will be asked to purchase Private Mortgage Insurance PMI to protect the mortgage lenders.

Thats usually the case if youre self-employed or have a. Some special loan programs even allow for 0 down payments. The minimum down payment is 35 with a credit score at or above 580 or 10 with a score between 500 and 579.

To qualify for a conventional loan on a second home youll likely need to put down at least 10 though some lenders require down payments of 20 to 25. Web Typically you can make a down payment as low as 3 to 5. But still a 20 down payment is considered ideal when purchasing a home.

With conventional mortgages if you do not make a down payment of 20 you will have to carry private mortgage insurance. Web Not to be confused with closing costs the down payment is the portion of the purchase price that you pay upfront at closing. There are a few stipulations to use the FHA Loan as well as additional steps that you.

This is on top of homeowners insurance so dont get the two confused.

How Much Should You Put Down On A House Not 20

42 Agreement Templates Word Pdf Apple Pages

Do You Need 20 Down To Buy A House Why This Old Rule No Longer Applies

Acceptable Down Payment Sources Mortgage New American Funding

2360 Austintown Warren Rd Mineral Ridge Oh 44440 Mls 4379159 Zillow

Down Payment Calculator How Much Should You Put Down

42 Sample Offer Letter Templates

What Is The Down Payment In A Real Estate Purchase America Mortgages

501 West Millers Cove Road Walland Tn 37886 Compass

Down Payment On A House How Much Do You Need

Glossary Of Mortgage Lending Terminology Rocket Mortgage

How Much Down Payment Do You Need To Buy A Home Nerdwallet

42 Reference Letter Templates Pdf Doc Reference Letter Template Reference Letter Sample Character Reference Letter

Xtool D9 Pro Automotive Diagnostic Scan Tool All Systems Car Scanner 42 Sevices Walmart Com

How Much Should You Put Down On A House Not 20

Credit Building App Credit Builder Program Moneylion

How To Decide How Much To Spend On Your Down Payment Consumer Financial Protection Bureau